Disputing / Protesting Your Military Debt

Do you disagree with your debt? The first thing you need to do is to understand exactly why you are in debt. Questions regarding the debt, reason for the debt, and the validity of the debt should be addressed with your finance, disbursing or payroll office. If you disagree with your debt, you may have the right to protest.

How to Dispute / Protest Your Debt

First, you must identify where your debt originated. To identify, please follow the below steps:

1. Locate Your Three Letter Debt Code on Your Debt Notification Letter

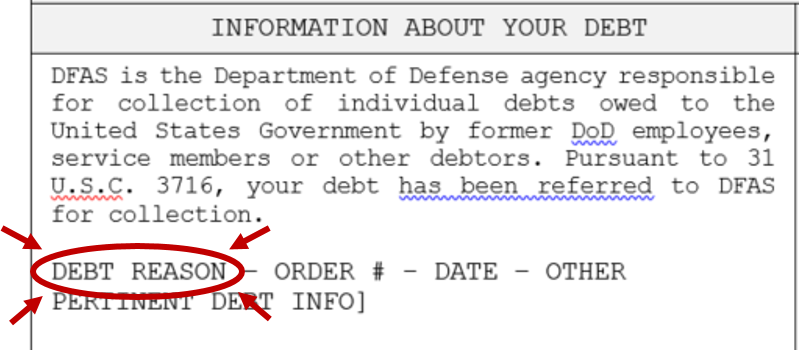

Your debt code can be found on the first page of your debt notification letter under “INFORMATION ABOUT YOUR DEBT.”

2. Search for Your Three Letter Debt Code Here:

Select your debt code from the below to be routed to the correct submission location. If you have multiple debts, please select each code.

Learn about Debt Waivers or Remission of Your Debt

If you agree with the debt, and the debt resulted from erroneous payments of wages or allowances this might be right for you. For additional information, visit Learn about Waivers or Remissions.

Return to the Debt and Claims DFAS Homepage

Page updated July 8, 2023