How to Identify the Status of Spouse/Former Spouse SBP Coverage on your Retiree Account Statement

Have you divorced since retiring? If so, please take a moment and carefully check your Survivor Benefit Plan (SBP) participation status. Under the law, SBP coverage for a spouse ends with a divorce. Coverage for a former spouse does not continue after the divorce unless certain actions are taken.

To continue SBP coverage for a former spouse, either (a) the retiree must voluntarily request coverage be continued for the former spouse, or, (b) the former spouse must request the coverage (but she/he may do so only if a court order requires the coverage). Certain time limits and other conditions apply.

If those actions were not taken, the coverage for the former spouse has ended. This could have important consequences for your survivors.

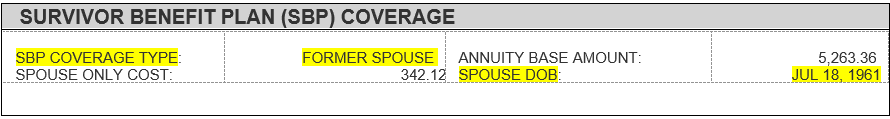

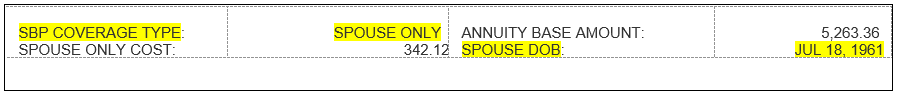

To check your SBP coverage status, review your Retiree Account Statement (RAS) carefully. Make sure the “SBP Coverage Type” properly reflects “former spouse” or “spouse” (as applicable to your individual circumstances).

We have seen multiple instances of spouse SBP premium deductions that were continued after a divorce but because required actions were not taken, the former spouse was not properly covered, preventing payment of an SBP annuity.

If your RAS looks like this, coverage for a former spouse is in place:

If your RAS looks like this, your former spouse is NOT being covered by the SBP even if her/his DOB is listed:

Note: The information on this website is provided to explain typical situations regarding retiree and annuitant benefits. For details and exceptions, please see applicable laws, financial management regulations, and instructions.

Page updated March 17, 2021