Transportation

You and your dependent(s) are permitted a transportation allowance from your old duty station to the new permanent duty station (PDS). Commercial air is the preferred mode of transportation for official travel. Airline reservations must be arranged as early as possible.

Things to keep in mind…

Dependent Travel: Dependent travel may begin from a point other than your old duty station; however, reimbursement is limited to the cost from your old duty station to your new duty station. Travel by dependents may be performed concurrently, early, or may be delayed. If your dependents are NOT traveling with you, they are performing an en route at an earlier/later date, be sure to mark unaccompanied in Block 12 of the 1351-2 and complete a separate 1351-2 for their travel dates. Be clear on who is traveling when completing the DD1351-2.

Your PCS order should indicate the number of travel days authorized in block 28 Typically, 1 or 2 days if travelling by air, depending on the location. Employee must sign an OCONUS Tour Agreement to receive PCS Allowances.

Transportation Types (Block 15c of 1351-2): See example below

Reimbursable Expenses (Block 18 of 1351-2): See example below

The following is provided for your convenience and are the most common miscellaneous reimbursable expenses. The following list is NOT all inclusive. For additional items, see: JTR Chapter 5 - 05013.

POV

- Ferry fares

- Tolls

- Parking fee (Reimbursement for parking POV at the terminal is limited to the cost of two one-way taxi fares.)

Commercial Transportation - Air, Train, Ship or Bus

- Fees for first checked bag

- Excess accompanied baggage when it is authorized or approved

- Transportation terminal mileage

- Baggage handling tips (traveler with a disability)

| |

For an employee to receive reimbursement for airfare, the orders must state “Individual Billed Account (IBA) Authorized for the purchase of airfare” or “Personally Procured Airfare Authorized.” IBA/CBA can be changed after the fact with an Authorizing Official's signature. Regardless of authorization type, submit the following items alongside your 1351-2:

- A complete flight itinerary, and

- A paid in full receipt

|

Government Transportation

- Gas and oil

- Ferry fares

- Tolls

- Parking fees (when authorized or approved)

Rental Vehicle (when authorized on the orders in advance of travel)

- Gas or oil (prepaid fueling is not authorized)

- Tolls (when authorized or approved)

- Ferry fares (when authorized or approved)

- Parking fees (when authorized or approved)

- Toll-collection transponder (when authorized or approved)

En Route Per Diem (Lodging, Meals & Incidentals)

Per diem is a taxable allowance made up of lodging, meals and incidentals expenses (M&IE). You and your dependents are authorized Per diem while you are en route to your new duty station. The en route portion of travel may require a separate 1351-2.

Meals & Incidentals Expenses (M&IE):

The M&IE rate is payable to you without itemization of expenses or receipts for anything under $75. To determine the rate, visit Defense Travel Management Office (DTMO). You will be paid 75 percent of the meal rate on the first and last day of travel. For example, if $50 is the meal per diem, then only $37.50 would be paid.

Lodging (block 15e of 1351-2): See example below

The number of days you are authorized per diem is determined based on the distance between your old duty station and new duty station. Lodging per diem is paid per the actual costs not to exceed the maximum rate, on the first day, but not the last. To determine the maximum rate, visit Defense Travel Management Office (DTMO).

Things to keep in mind...

- Paid/Itemized lodging receipts are always required.

- No per diem is authorized for travel less than 12 hours.

- When the total official distance is 400 or fewer miles, one day of travel time is allowed.

- If the distance is greater than 400 miles, divide by 350 to determine the number of authorized travel days.

Household Goods (HHG) Movement & Storage

You and your dependent(s) are permitted to transportation and storage of HHG. This is a taxable allowance and will require a separate 1351-2.

Household Goods (Block 14 of 1351-2):

There are two ways the government may pay for HHG movement and storage:

- If the government arranges for the movement of your household goods, you will need to contact the Transportation Office (TO) closets to your new location to arrange the allowance and storage of household goods. Visit, DoD Moving Portal to locate the nearest TO. The government assumes the responsibility of moving your goods and no claim reimbursement is required.

- If you choose to personally arrange your move in lieu of using the TO, you will be reimbursed for actual expenses incurred (boxes, packing tape, rental truck, gas, etc.) not to exceed what it would cost the government to move your HHG shipment through the TO.

Things to keep in mind...

- If you choose to move yourself, you will be taxed at the time of claim reimbursement.

- All paid in full receipts are required.

- Insurance is not reimbursable on a personally arranged move.

- You must submit a signed memo from the TO stating what the move would have cost for the weight shipped.

- Temporary storage (storage in transit (SIT)) is limited to your actual storage costs. CONUS: authorized for 60 days initially with a maximum allowance of 150 days upon written request. OCONUS: authorized for 90 days initially with a maximum allowance of 180 days upon written request.

- The maximum weight allowance is 18,000 pounds (an additional 2,000 for packing materials when uncrated or van line shipment).

Items That Cannot be Shipped:

These are the most common items but is NOT all inclusive. For additional information, please see: JTR Chapter 5, Table 5-89

- Motor vehicles, boats that cannot fit into a van (whether or not actually shipped by van), airplanes, mobile homes, camper trailers, and farming vehicles

- Live animals, birds, fish, and reptiles, please see: JTR Chapter 5, paragraph 054103 Pet Quarantine and Transportation

- Building materials

- Property for resale, disposal, or commercial use rather than for use by you or immediate family

- Privately owned live ammunition

- Hazardous articles including explosives, flammable and corrosive materials, poisons, etc.

Privately Owned Vehicle (POV) Shipping

You may be permitted shipment of a passenger automobile, station wagon, light truck, or a similar vehicle that will be used primarily for your transportation. This is a taxable allowance and will require a separate 1351-2.

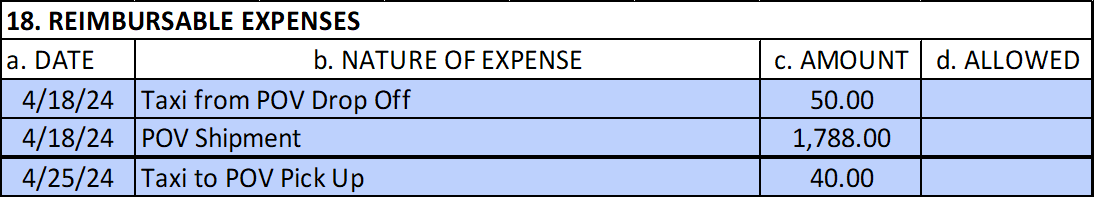

Shipment (Block 18 of 1351-2): See example below

You can be reimbursed the shipment costs for one passenger vehicle. Work with your local transportation office to ensure proper shipment of your POV.

Things to keep in mind…

- Rental car is not reimbursable while awaiting POV arrival.

- You cannot transport or store a trailer, airplane, or any vehicle intended for commercial use.

Drop Off and/or Pick Up (Block 18 of 1351-2): See example below

POV Drop off and Pick up is an entitlement that allows you to be compensated for your transportation costs to drop-off and pick-up your vehicle at the authorized Vehicle Processing Center (VPC). Reimbursement includes transportation expenses only for one authorized traveler limited to a round trip by way of the most direct route to pick-up or drop-off your vehicle at the VPC.

Real Estate Purchase and or Sale

This option is only available if the old or new duty stations are in Alaska, Hawaii, the commonwealths of Puerto Rico and the Northern Mariana Islands, Guam or U.S. territories and possessions.

All real estate sale and purchase claims require you to prepare and submit DD Form 1705 (Reimbursement for Real Estate Sale and/or Purchase Closing Cost Expenses) to be reimbursed for expenses. The DD Form 1705 can be found on the Civilian PCS Forms page.

A designated official must review the expenses claimed are reasonable in amount and customarily paid by the seller or buyer (as appropriate) in the location of the property and sign the DD Form 1705. The reviewing official may use the service of available legal officers in determining whether any claimed item is an authorized real estate expense or a finance charge under the Truth in Lending Act (15 U.S.C. §1601). This is a taxable allowance and will require a separate 1351-2 for the sale and the purchase.

Reimbursable Expenses (Block 18 of 1351-2): See example below.

Home sale and purchase claims should be submitted on separate 1351-2’s for the sale your home at your current duty station and purchase of new housing at the new duty station with applicable supporting documentation attached to each voucher.

- Column a) List the real estate transaction closing date

- Column b) Specify Real Estate Sale or Real Estate Purchase

- Column c) List the total expense amount as approved on DD Form 1705, block 20

For more information regarding reimbursable relocation expenses and rates, visit General Services Administration (GSA)-Residence Transaction Expenses-Home Purchase Reference

Real Estate Purchase/Sale documents to include with submission of 1351-2:

- Completed/approved/signed DD Form 1705

- Purchase or sales contract signed by buyer and seller

- Copy of the signed settlement statement or Closing Disclosure Statement

- Paid in full receipts for items paid outside of closing

- Copy of your PCS Orders.

Things to keep in mind…

- The settlement/closing must be complete before the one-year anniversary of your report at the new duty station. An extension of up to an additional year may be granted by the agency’s approving official.

- Home sale and purchase claims should be submitted separately with applicable supporting documentation attached.

- Reimbursement must not exceed 10% of the actual sale price on a Sale of Residence at the old PDS.

- Reimbursement must not exceed 5% of the purchase price on a Purchase of Residence at the new PDS.

Unexpired Lease

This option is ONLY available if the old or new duty stations are in Alaska, Hawaii, the commonwealths of Puerto Rico and the Northern Mariana Islands, Guam or U.S. territories and possessions.

Unexpired lease reimbursement is authorized for expenses incurred due to the early termination of a lease agreement. This is a taxable allowance and will require a separate 1351-2.

All unexpired lease expenses to include fees for obtaining a sublease or charges for advertising an unexpired lease and fees incurred for settling an unexpired lease (including month-to month rental) on a residence you occupied at the old PDS.

The following conditions must be met for reimbursement to be authorized:

- Applicable laws or the lease terms provide for payment of settlement expenses.

- They cannot be avoided by subleasing or other arrangement.

- You have not contributed to the expense, for example, by failing to give appropriate lease termination notice promptly after you receive official notification of the date of transfer.

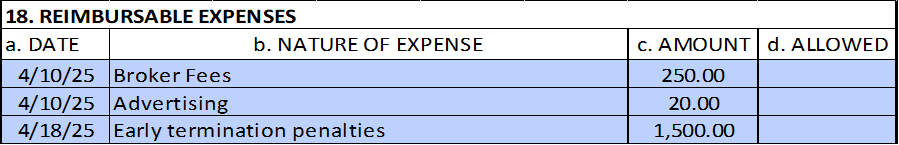

Reimbursable Expenses (Block 18 of 1351-2): See example below.

Unexpired lease claims should be submitted on a separate 1351-2 for the reimbursement of costs you incur for the settlement of your unexpired lease. The allowable costs are limited to the early termination of your lease.

- Column a) List the date unexpired lease expenses were paid.

- Column b) List each lease termination expense separately

- Column c) List the total expense amount

Unexpired Lease documents to include with submission of 1351-2:

- Copy of the original lease signed by you and the landlord and all renewal agreements./addendums as applicable.

- Copy of the Notification of Intent to vacate that was provided to the landlord.

- Copy of the letter from the landlord accepting the terms to vacate.

- Signed statement providing the exact date the apartment/house was vacated.

- Paid in full itemized receipt/ledger showing the lease termination fees.

- Copy of your PCS Orders.

Things to keep in mind…

- Only applies to CONUS and Non-Foreign OCONUS locations

- Advance of Unexpired Lease is not authorized.

Miscellaneous Expense Allowance (MEA)

MEA is an allowance to cover various costs associated with PCS that are not covered by other PCS allowances and is payable when you vacate a residence at your old Permanent Duty Station (PDS) and establish a new temporary or permanent residence at your new PDS. This is a taxable allowance and may require a separate 1351-2.

MEA Statement (Block 15 of 1351-2):

Insert this statement in Block 15 b of the DD Form 1351-2 with your claim: “I certify that we have discontinued our residence at the old PDS and have established a residence at the new PDS.”

Reimbursable Expenses (Block 18 of 1351-2):

There are two methods of MEA that may be authorized:

1.MEA Flat Payment:

To claim the flat rate place the date in Block 18a and type MEA in Block 18b. The amount you’re entitled to depends on the date your orders were issued:

Orders issued prior 1/15/2025 you’re allotted:

- Employee and no dependents = $650

- Employee plus dependents = $1,300

Orders issued on or after 1/15/2025 you’re allotted:

- Employee and no dependents = $905

- Employee plus dependents = $1,810

NOTE: Receipts are not required for MEA Flat Payment claims.

2.MEA Above Flat Rate - Itemized:

The AO may authorize an MEA for more than the flat-rate amount if the claim is justified by receipts of expenses incurred. The total is limited to the following:

- Your one-week salary to include locality, for you without dependents at the new permanent duty station, or

- Your two-week salary to include locality, for you with dependent(s) at the new permanent duty station,

NOTE: To claim itemized expenses above the flat rate you will be required to submit a Leave and Earnings Statement (LES) and all paid in full receipts (regardless of the amount). Payment is not to exceed the GS-13 step 10 pay scale. Place itemize claims in Block 18b and include dollar amounts being claimed in Block 18c of your 1351-2.

How to Submit your MEA Voucher:

See the voucher submission page for detailed instructions.

The AO signature and date are required if claiming itemized MEA and the date must be the same day or after the Reviewer.

Examples of Common MEA Reimbursable Expenses:

Below are the most common items that are reimbursable, but this is NOT all inclusive. For a complete list, visit JTR Chapter 5, Table 5-81

- Disconnecting or connecting appliances, equipment, and utilities involved in relocation, and converting appliances for operation on available utilities.

- Non-refundable utility fees or deposits.

- Cutting and fitting rugs, draperies, and curtains moved from one residence to another.

- Pet care, childcare, or adult care for dependent parents or other adult dependents incapable of self-care at home while you or your spouse are away on an HHT or are packing or unpacking.

- Pet transportation charges are not a separately reimbursable expense but may be claimed using MEA Above Flat Rate – Itemized.